As a sole proprietor, you enjoy the simplicity of running your business on your own. However, as your business grows, you may start considering the benefits of forming a limited liability company (LLC).

An LLC provides a number of advantages, including liability protection, tax flexibility, and the ability to attract investors. In this article, we’ll guide you through the process of converting your sole proprietorship to an LLC.

We’ll cover everything you need to know, from the legal requirements and paperwork to the benefits and drawbacks of making the switch.

By the end of this article, you’ll have a clear understanding of how to change from a sole proprietorship to an LLC and whether it’s the right decision for your business.

Advantages of Converting from a Sole Proprietorship to an LLC

There are several advantages to converting from a sole proprietorship to an LLC. Here are a few of them:

1. Limited Liability Protection

One of the main benefits of forming an LLC is that it provides limited liability protection to its owners. As a sole proprietor, you are personally responsible for all of your business’s debts and liabilities.

If your business is sued or faces financial trouble, your personal assets are at risk. However, with an LLC, your personal assets are protected, and your liability is limited to the assets of the business.

2. Tax Benefits

Another advantage of converting to an LLC is the tax benefits. LLCs offer the option of being taxed as a pass-through entity, which means that the business’s income is only taxed once on the owner’s personal tax return.

This can result in significant tax savings compared to a sole proprietorship, where all income is subject to self-employment taxes.

3. Credibility and Professionalism

Forming an LLC can also add credibility and professionalism to your business.

LLCs are seen as more formal and legitimate than sole proprietorships, which can make your business more attractive to customers, investors, and lenders.

4. Easier to Raise Capital

LLCs are also generally easier to raise capital for than sole proprietorships. With an LLC, you can sell ownership shares in the business to investors, which can help you raise funds to grow your business.

By converting from a sole proprietorship to an LLC, you can gain these advantages and more.

However, there are also some potential drawbacks to consider. Let’s explore those in the next section.

Benefits of Changing from Sole Proprietorship to LLC

Converting from a sole proprietorship to an LLC has several benefits. In this section, we will discuss some of the key advantages of changing to an LLC structure.

Limited Liability Protection

Unlike a sole proprietorship, an LLC provides limited liability protection to its owners, which means that their personal assets are protected if the business is sued or faces financial difficulties.

Tax Benefits

LLCs offer a range of tax benefits, including pass-through taxation, where the profits and losses of the business are passed through to the individual owners and are reported on their personal tax returns. This can result in lower overall tax rates for the business.

Credibility and Permanence

Operating as an LLC can help to enhance the credibility of a business. It can also make it easier to secure financing and attract new customers. Additionally, an LLC can provide a more permanent business structure that can outlast the owner’s involvement in the business.

Flexibility in Ownership and Management

LLCs offer flexibility in ownership and management structures, making it easier to bring on new partners or investors, and to delegate management responsibilities.

Personal Asset Protection

In addition to protecting business assets, LLCs can also help to protect personal assets from business-related lawsuits and claims.

Overall, the benefits of changing from a sole proprietorship to an LLC are numerous and can provide a more secure and flexible business structure for the owner(s).

Steps to Change from Sole Proprietorship to LLC

Once you have decided to change your business structure from a sole proprietorship to an LLC, you need to follow precise steps.

Before continuing with them, we did some research, to make it easier for you. Consider this as a tip for any further actions: DO A RESEARCH.

At Quora we found this topic, that you can read the experience of other enthusiasts like yourself.

1. Choose a Name for Your LLC

Before you can register your LLC, you need to choose a name that complies with your state’s regulations.

The name should not be too similar to an existing business name and should include the words “Limited Liability Company” or the abbreviation “LLC.” You can check the availability of the name on your state’s business registration website.

2. File Articles of Organization

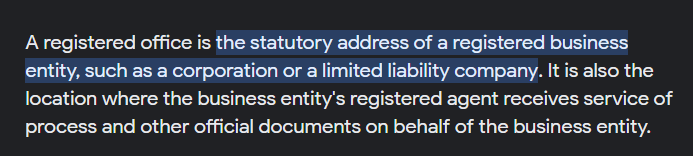

The Articles of Organization is a legal document that establishes your LLC as a legal entity. You need to file this document with your state’s Secretary of State or equivalent agency.

The document should include the name and address of your LLC, the names and addresses of the owners, and the name of the registered agent.

3. Obtain Required Permits and Licenses

Depending on your business type and location, you may need to obtain certain permits and licenses to operate your LLC legally. These permits and licenses vary by state, industry, and business type.

You can check with your state’s business license department to see what permits and licenses you need.

4. Apply for an EIN

An Employer Identification Number (EIN) is a unique number assigned to your LLC by the Internal Revenue Service (IRS).

You need this number to open a bank account, file taxes, and hire employees. You can apply for an EIN online on the IRS website.

5. Update Your Business Accounts

Once you have completed the above steps, you need to update your business accounts, such as bank accounts, credit cards, and contracts, with your new LLC information.

By following these steps, you can successfully change your business structure from a sole proprietorship to an LLC.

However, it is recommended that you consult with a tax professional or a business lawyer to ensure that the process is done correctly and in compliance with your state’s regulations.

Next, we’ll discuss the advantages of changing from a sole proprietorship to an LLC.

Steps to Convert a Sole Proprietorship to an LLC

Converting your sole proprietorship to an LLC involves several key steps. Follow the steps below to ensure a smooth and successful transition:

Step 1: Research Your State’s Requirements

Each state has its own laws and regulations regarding LLCs. Research the requirements in your state to ensure you follow the correct steps. You can usually find this information on your state’s Secretary of State website.

Step 2: Choose a Name for Your LLC

Once you have researched your state’s requirements, you will need to choose a name for your LLC. The name must be unique and not already in use by another business in your state. You will also need to include the words “Limited Liability Company” or an abbreviation (LLC) in the name.

Step 3: File Articles of Organization

The Articles of Organization is the document that officially creates your LLC. This document will need to be filed with your state’s Secretary of State. You will need to provide information about your LLC, such as the name, address, and members or managers.

Step 4: Obtain any Required Permits or Licenses

Depending on the type of business you have, you may need to obtain certain permits or licenses before you can legally operate as an LLC. Research the requirements in your state and obtain any necessary permits or licenses.

Step 5: Draft an Operating Agreement

An Operating Agreement is a document that outlines the ownership structure and operating procedures of your LLC. It is not required by law in all states, but it is highly recommended. This document can help prevent disputes among members and provide clarity on how the business will operate.

Step 6: Update Your Business Records

After you have completed the steps above, make sure to update all of your business records to reflect the change from a sole proprietorship to an LLC. This includes updating any contracts, licenses, and permits.

By following these steps, you can successfully convert your sole proprietorship to an LLC.

However, it is important to note that the process can be complex and time-consuming. Consider consulting with a legal or tax professional to ensure a smooth transition.

Stay tuned for the next section, where we’ll go over some frequently asked questions about converting from a sole proprietorship to an LLC.

File the Necessary Paperwork

Once you have chosen the type of LLC and obtained an EIN, it is time to file the necessary paperwork. The process for filing the paperwork to change from a sole proprietorship to an LLC can vary by state, but it generally involves the following steps:

Name reservation:

Choose a name for your LLC and make sure it is available for use in your state. You may need to reserve the name with your state’s business registration office.

Articles of Organization:

File articles of organization with your state’s business registration office. This document outlines the basic information about your LLC, such as its name, purpose, and address.

Operating Agreement:

Draft an operating agreement that outlines the management structure and ownership of the LLC. This document is not required in all states, but it is a good idea to have one to prevent disputes in the future.

Fees:

Pay any necessary filing fees. The fees can vary by state, but they typically range from $100 to $500.

Publication:

In some states, you may need to publish a notice of your LLC formation in a local newspaper.

It is important to check with your state’s business registration office for specific requirements and deadlines for filing the necessary paperwork. Some states may also require additional forms or filings.

Once you have filed the necessary paperwork and paid the fees, you will officially be an LLC. Congratulations!

You can now start conducting business as an LLC, and enjoy the many benefits of this type of business structure.

But before you start conducting business, it is important to make sure you are in compliance with all local, state, and federal laws and regulations.

This includes obtaining any necessary licenses and permits, registering for taxes, and complying with employment laws.

Conclusion: Switching from Sole Proprietorship to LLC

Converting your business from a sole proprietorship to an LLC can be a smart move for many reasons. It can offer you greater legal protection, lower your tax liability, and even improve your overall credibility as a business owner.

While the process of changing from a sole proprietorship to an LLC may seem daunting, it’s actually relatively straightforward if you follow the necessary steps.

Start by researching the laws and regulations in your state, selecting a business name and registering it, and then filing the necessary paperwork with your state’s Secretary of State office.

If you’re unsure of where to begin or would like professional guidance, consider hiring a qualified business attorney or tax professional. They can provide invaluable assistance in navigating the legal and financial aspects of changing your business structure.

Remember, switching from a sole proprietorship to an LLC is an investment in your business’s future. By taking the necessary steps now, you can help secure your company’s financial stability and position it for long-term success.

Be aware of the most common mistakes that small business owners do and make sure to explore the benefits of an outsourcing bookkeeping service.

When doing business you should consider some important financial reports that you need to prioritize.

Also, take your time and set a time frame in order to know at what point you will start researching and calculating the best option: in-house vs. full-charge bookkeeping.

We understand that as a small business owner, you have to run a marathon in order to grow your business, but just let us know if we could support you with our services.