Being a small business owner can be overwhelming. Especially when it comes to keeping your finances in order and maintaining precise bookkeeping records. Fortunately, with the rise of bookkeeping software, managing your finances has become much easier and less time-consuming.

On the other hand, having several bookkeeping software options, and choosing the right one can be overwhelming.

In this article, on top of our minds is to discuss the key features to consider when choosing small business accounting software. Even when you recommend the top bookkeeping programs available in the market.

By the end of this article, you will have a clear understanding of what to look for in a bookkeeping program and the best software options for your business.

Using bookkeeping software not only saves you time but also helps you:

- make informed financial decisions,

- minimize errors, and

- streamline your accounting processes.

Without further ado, let’s dive into the world of small business bookkeeping software!

Key features to consider when choosing small business accounting software

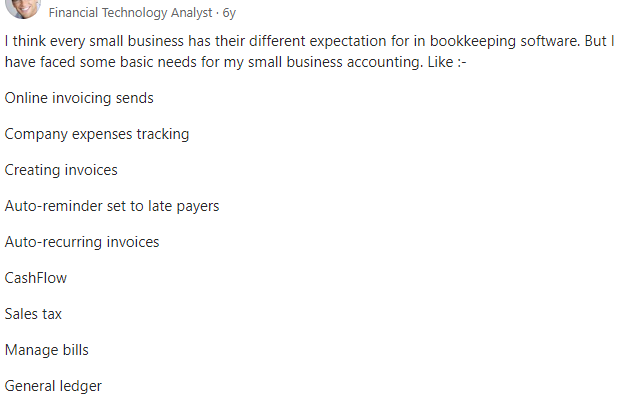

All the details that you must have in mind when deciding can be stressful. And when stress prevails, errors are inevitable.

Since we always strive to share insight with you, so here is a post from experience. Source: Quora

And now, let’s move forward. In order to give you peace of mind when choosing bookkeeping software for your small business, here are some key features you might want to consider:

Scalability and Customization

Your small business may be growing, and you need bookkeeping software that can accommodate your needs as you expand. Scalability is a crucial feature to consider when selecting a bookkeeping program.

You want to choose software that can grow with your business and is flexible enough to meet your changing needs.

Additionally, you should consider software that allows the customization of templates, reports, and invoicing to suit your business requirements.

User Interface and Ease of Use

Start from your point of you. As a user ask yourself, what is important for your workflow?

Your bookkeeping software should have an intuitive user interface that is easy to navigate. This feature is essential, especially if you or your team have limited accounting experience.

You don’t want to spend hours learning how to use the software or have to pay someone to do it for you.

Choose software that offers user-friendly dashboards, clear menu options, and straightforward instructions. The easier the software is to use, the more time you will save on bookkeeping.

Bookkeeping Software Pricing

Pricing is a critical factor to consider when selecting a bookkeeping program. You want software that is affordable and within your budget.

However, be cautious of free bookkeeping software as it may lack essential features that your business needs.

Additionally, consider the cost of upgrades, support, and any add-ons that may be required. Make sure you understand the pricing structure before committing to bookkeeping software.

Since pricing is the topic, we suggest that you read our article for bookkeeping prices.

Integration with Other Business Tools

Your bookkeeping software should integrate seamlessly with other business tools, such as payment gateways, CRM software, and project management tools.

Integration is essential in streamlining your business operations, reducing data entry errors, and increasing efficiency.

Data Security and Backup

Data security is crucial when it comes to bookkeeping software. You want software that is secure, protects your data from cyber threats, and has a backup feature to ensure you don’t lose your data in case of a system failure.

Choose bookkeeping software that provides encryption, regular backups, and robust security features to safeguard your data.

Consider these key features when selecting bookkeeping software for your small business.

Now that we have covered the essential features to consider let’s dive into the top small business accounting software programs available in the market.

Top Small Business Accounting Software Programs

QuickBooks Online

QuickBooks Online is a cloud-based bookkeeping software that offers a wide range of features to small business owners. It has an intuitive user interface, and the platform is easy to use, making it a popular choice among small business owners.

Key Features:

- Invoicing: Create and send custom invoices to clients and track payment status.

- Expense Tracking: Categorize and track expenses to get a better understanding of your business finances.

- Payroll Processing: Run payroll and pay employees easily and accurately.

- Inventory Management: Track inventory levels and set reorder points to ensure you never run out of stock.

- Reporting: Get insights into your business finances with customizable reports.

- Integrations: Connect QuickBooks Online with other business tools such as payment gateways, CRM software, and project management tools.

Pricing:

QuickBooks Online pricing ranges from $25 to $150 per month, depending on the features and plan you choose.

Xero

Xero is another popular cloud-based bookkeeping software that offers features such as invoicing, expense tracking, payroll processing, inventory management, and reporting. It has an intuitive user interface, and the platform is easy to use, making it ideal for small business owners.

Key Features:

- Invoicing: Create and send custom invoices to clients and track payment status.

- Expense Tracking: Categorize and track expenses to get a better understanding of your business finances.

- Payroll Processing: Run payroll and pay employees easily and accurately.

- Inventory Management: Track inventory levels and set reorder points to ensure you never run out of stock.

- Reporting: Get insights into your business finances with customizable reports.

- Integrations: Connect Xero with other business tools such as payment gateways, CRM software, and project management tools.

- Mobile App: Access your finances on the go with the Xero mobile app.

Pricing:

Xero pricing ranges from $11 to $62 per month, depending on the features and plan you choose.

FreshBooks

FreshBooks is a cloud-based bookkeeping software that is ideal for service-based businesses. It offers features such as invoicing, time tracking, expense tracking, and project management.

FreshBooks has an intuitive user interface, and the platform is easy to use, making it a great choice for small business owners who want to save time on bookkeeping.

Key Features:

- Invoicing: Create and send professional-looking invoices to clients and track payment status.

- Time Tracking: Track billable hours and manage project budgets.

- Expense Tracking: Categorize and track expenses to get a better understanding of your business finances.

- Project Management: Collaborate with team members and clients on projects.

- Integrations: Connect FreshBooks with other business tools such as payment gateways and project management tools.

- Mobile App: Access your finances on the go with the FreshBooks mobile app.

Pricing:

FreshBooks pricing ranges from $15 to $50 per month, depending on the features and plan you choose.

Zoho Books

Zoho Books is another cloud-based bookkeeping software that offers a wide range of features, including invoicing, expense tracking, project management, and inventory management.

It has an intuitive user interface, and the platform is easy to use, making it a great choice for small business owners who want to streamline their bookkeeping processes.

Key Features:

- Invoicing: Create and send custom invoices to clients and track payment status.

- Expense Tracking: Categorize and track expenses to get a better understanding of your business finances.

- Project Management: Collaborate with team members and clients on projects.

- Inventory Management: Track inventory levels and set reorder points to ensure you never run out of stock.

- Reporting: Get insights into your business finances with customizable reports.

- Integrations: Connect Zoho Books with other business tools such as payment gateways, CRM software, and project management tools.

Pricing:

Zoho Books’ pricing ranges from $9 to $29 per month, depending on the features and plan you choose.

Wave

Wave is a free cloud-based bookkeeping software that offers features such as invoicing, expense tracking, and receipt scanning. It is a popular choice among small business owners who want simple and easy-to-use bookkeeping software without breaking the bank.

Key Features:

- Invoicing: Create and send custom invoices to clients and track payment status.

- Expense Tracking: Categorize and track expenses to get a better understanding of your business finances.

- Receipt Scanning: Scan receipts and automatically import them into Wave.

- Reporting: Get insights into your business finances with customizable reports.

Pricing:

Wave is free to use, but it offers paid add-ons such as payroll processing and payment processing for a fee.

Conclusion

Choosing the right small business accounting software can be overwhelming, but it is essential for the success of your business.

Consider the key features we outlined in this article when choosing a bookkeeping program for your business.

The software programs we listed are all great options for small business owners, but you should choose the one that fits your business needs and budget the best.

When speaking of choosing the right, you might read our article issuing bookkeeping services vs DIY bookkeeping.

We hope this article has helped you understand the importance of using online small business accounting software and the key features to consider when choosing bookkeeping software for small businesses.

Remember, proper bookkeeping is crucial for the success of your business, and choosing the right software can save you time and money in the long run.

If you have any questions or need help choosing the right bookkeeping software for your business, feel free to contact us. We are always here to help!

Frequently Asked Questions (FAQs)

Is online small business accounting software safe?

Yes, online small business accounting software is generally safe to use. Most software providers use advanced security measures to protect your data, such as data encryption, multi-factor authentication, and regular backups.

However, it’s important to choose a reputable provider and follow best practices such as using strong passwords and avoiding public Wi-Fi when accessing your account.

Do I need accounting knowledge to use bookkeeping software for small businesses?

You don’t necessarily need accounting knowledge to use bookkeeping software for small businesses. Most software programs are designed to be user-friendly and intuitive, with features such as invoicing, expense tracking, and financial reporting.

Nevertheless, having a basic understanding of accounting principles and practices can be helpful in using the software effectively.

We provided an article for a P & L statement that can be useful for you.

Can I use small business bookkeeping software on my mobile device?

Many bookkeeping software programs offer mobile apps that allow you to access your account and perform basic tasks. These tasks can be: creating and sending invoices, tracking expenses, and reviewing financial reports.

Still, not all features may be available on the mobile app, so it’s important to check with the provider to ensure the app meets your needs.

What is the best bookkeeping software for small businesses with inventory management needs?

If you have inventory management needs, consider using software programs such as QuickBooks Online or Zoho Books.

These software offer inventory tracking and management features. You can track inventory levels, set reorder points, and generate reports to help you manage your inventory effectively.

You might find the article about bookkeeping automation insightful, and use it as a guide.

Can I use bookkeeping software to track my business’s cash flow?

Most bookkeeping software programs offer cash flow tracking features that allow you to monitor your business’s inflows and outflows of cash.

You can view your cash balance, monitor cash flow trends, and generate reports to help you make informed financial decisions.