It’s likely that you need to submit Form 1096 to the IRS if you paid an independent contractor to do work for you this year.

What is Form 1096? Who needs to file one? And how exactly does it work?

Here’s everything you need to know as a small business owner:

What is Form 1096?

Form 1096 is a crucial document used by small business owners in the United States to summarize and transmit various types of 1099 forms to the IRS.

It serves as a cover sheet or transmittal form for reporting payments made to individuals or entities, such as independent contractors, interest income, and dividend income.

Form 1096 provides a summary of all the information returns being submitted to the IRS. It is an essential part of fulfilling your tax reporting obligations as a small business owner.

If you have filed or will file any 1099 forms, understanding Form 1096 and its purpose is essential. Keep reading to learn more about this important form.

What does it look like?

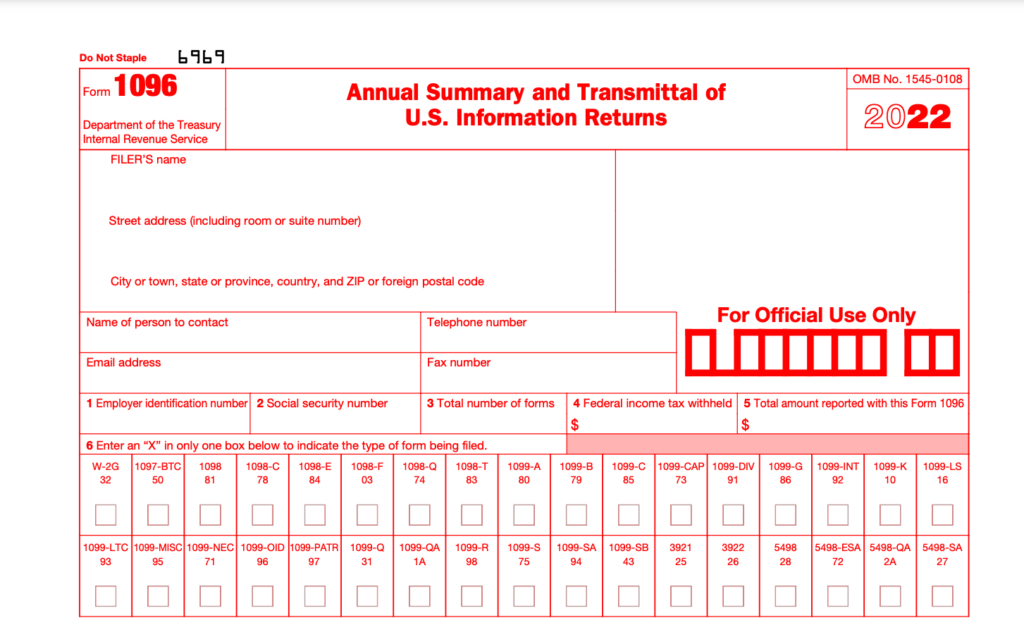

Form 1096 is a one-page form that is usually printed on white paper and contains various fields for you to complete.

The form includes spaces for your name, address, and taxpayer identification number. Here we can add boxes to indicate the type of form being transmitted, the total number of forms being transmitted, and the total amount reported.

Form 1096 also includes a box to provide an explanation for corrections, if any and a signature line for you to sign as the filer.

It’s important to carefully review and complete all the required fields on Form 1096 to ensure accurate and timely submission to the IRS.

Familiarize yourself with the layout and fields of Form 1096 to ensure you can accurately complete and submit the form to the IRS.

Here’s one example:

How many Form 1096s do I have to file?

As a small business owner, the number of Form 1096s you need to file depends on the number of 1099 forms you are submitting to the IRS. Generally, you are required to file one Form 1096 for each type of 1099 form you are transmitting.

For example, if you are submitting Form 1099-MISC and Form 1099-INT to the IRS, you will need to file a separate Form 1096 for each type of form.

Each Form 1096 should contain a summary of the total number of forms being transmitted and the total amount reported for that specific type of form.

Keep in mind the requirement to file one Form 1096 for each type of 1099 form you are transmitting and ensure you have the appropriate number of forms ready for submission.

Can I print Form 1096 off the internet?

Yes, you can print Form 1096 from the IRS website. The IRS provides fillable PDF versions of Form 1096 that you can download and print for free.

These fillable forms allow you to enter your information electronically before printing. This can help reduce errors and ensure accurate submission to the IRS.

It’s important to note that the IRS requires you to print Form 1096 on paper that meets specific criteria, such as white paper of at least 20-pound weight and printed in black ink.

Using the IRS-provided fillable PDF versions of Form 1096 can help ensure that you meet these requirements and submit a valid form to the IRS.

Visit the IRS website to download and print the fillable PDF versions of Form 1096 for accurate and compliant submission to the IRS.

How do I order a scannable version of Form 1096 from the IRS?

If you prefer to use a scannable version of Form 1096, you can order them directly from the IRS.

Scannable versions of Form 1096 are pre-printed forms that have a unique serial number and can be read by IRS scanning equipment for faster processing.

To order scannable versions of Form 1096, you can complete Form 1096-A, which is the “Annual Summary and Transmittal of U.S. Information Returns” form. This form is used specifically for submitting scannable versions of Form 1096.

If you prefer to use scannable versions of Form 1096 for faster processing, consider ordering them directly from the IRS using Form 1096-A.

Can I order these forms over the phone?

Yes, you can order Form 1096 and other tax forms from the IRS over the phone. The IRS has a dedicated toll-free number for ordering tax forms, including Form 1096. You can call the IRS at 1-800-TAX-FORM (1-800-829-3676) to place an order.

When ordering forms over the phone, make sure to provide the correct form number, Form 1096, and the quantity you need.

The IRS will then ship the forms to the address you provide, usually within 10 business days.

If you prefer to order Form 1096 and other tax forms over the phone, call the IRS at 1-800-TAX-FORM to place an order.

Can I file Form 1096 electronically?

Yes, you can file Form 1096 electronically through the IRS Filing Information Returns Electronically (FIRE) system.

The FIRE system allows you to submit Form 1096 and other information returns electronically, which can save you time and effort compared to filing paper forms.

To file Form 1096 electronically, you need to register for an account on the IRS FIRE system and follow the instructions for submitting the form electronically.

The IRS provides detailed guidance and specifications for electronic filing, including file formats, record layouts, and validation rules, to ensure accurate and compliant submission.

Consider filing Form 1096 electronically through the IRS FIRE system for a more efficient and convenient way to fulfill your tax reporting obligations.

When is Form 1096 due?

Form 1096 is generally due to the IRS by the last day of February following the calendar year for which the information returns are being submitted.

For example, if you are submitting information returns for the calendar year 2022, Form 1096 is due to the IRS by February 28, 2023.

However, if you are filing electronically, the due date is extended to March 31, 2023. It’s important to note that Form 1096 is a transmittal form and must be submitted to the IRS along with the corresponding 1099 forms.

Mark your calendars and ensure that you submit Form 1096 and the corresponding 1099 forms to the IRS by the appropriate due date to avoid any penalties or late filing fees.

Conclusion

Form 1096 is an important document that small business owners in the US use to summarize and transmit various types of 1099 forms to the IRS.

It serves as a cover sheet or transmittal form and provides a summary of all the information returns being submitted. Understanding how to properly complete and submit Form 1096 is crucial to fulfilling your tax reporting obligations.

Before you go: In-House Bookkeepers vs. Full-Charge Bookkeepers For SMBs.

In this article, we covered the basics of Form 1096, including what it is, what it looks like, how many Form 1096s you need to file, how to obtain and order Form 1096, electronic filing options, and the due date for submitting Form 1096 to the IRS.

We hope this information has been helpful in guiding you through the process of using Form 1096 for your small business tax reporting needs.

Remember to always review and follow the latest IRS instructions and requirements to ensure accurate and compliant submission of Form 1096 and other tax forms.